The take-profit limit is the amount of pips that you’ll accumulate in your favor before cashing out. The stop-loss limit is the maximum amount of pips (price variations) that you can afford to lose before giving up on a trade. You also set stop-loss and take-profit limits. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. The tick is the heartbeat of a currency market robot. During slow markets, there can be minutes without a tick.

During active markets, there may be numerous ticks per second.

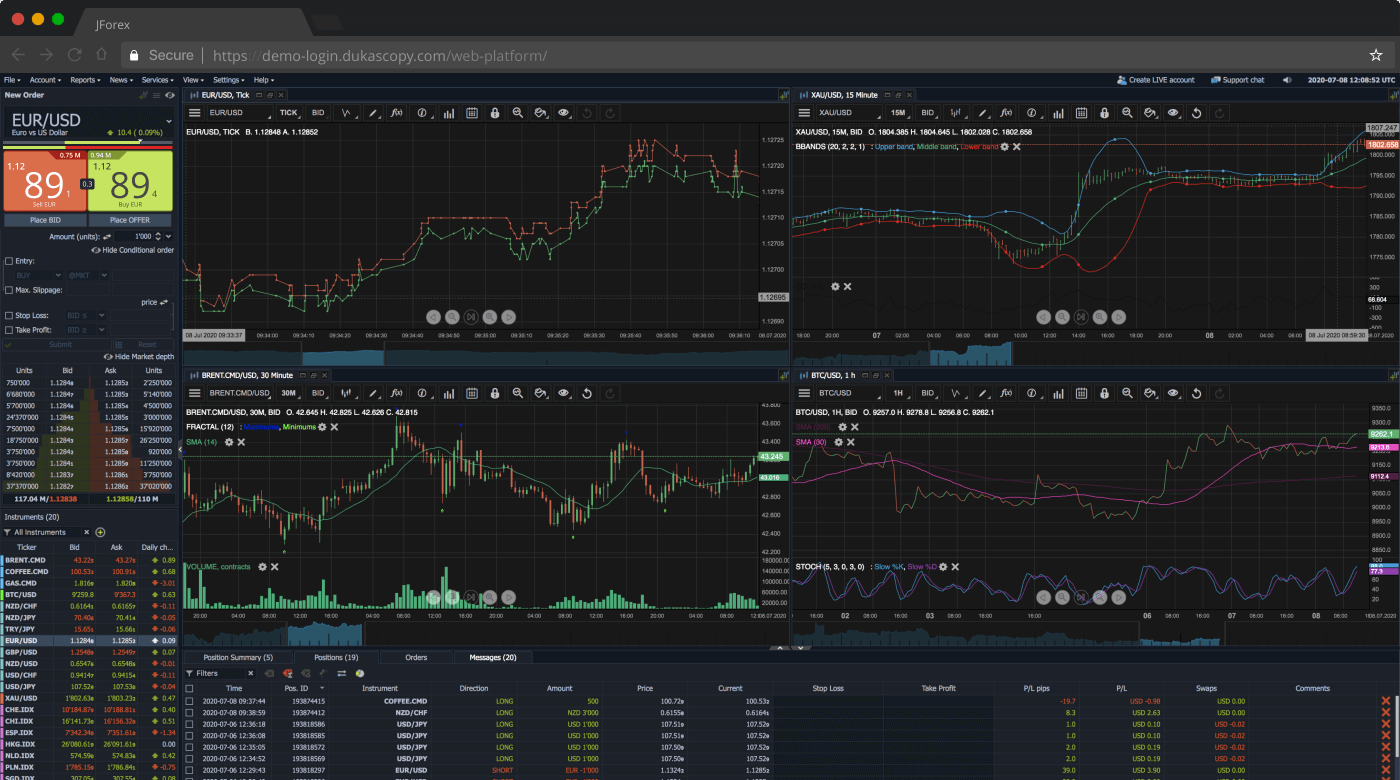

In other words, a tick is a change in the Bid or Ask price for a currency pair. The movement of the Current Price is called a tick. Through Meta Trader 4, you can access all this data with internal functions, accessible in various timeframes: every minute (M1), every five minutes (M5), M15, M30, every hour (H1), H4, D1, W1, MN. For readers unfamiliar with Forex trading, here’s the information that is provided by the data feed: The broker then provides a platform with real-time information about the market and executes your buy/sell orders. The role of the trading platform (Meta Trader 4, in this case) is to provide a connection to a Forex broker. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier.

#Go forex app for pc software#

The client wanted algorithmic trading software built with MQL4, a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. I thought that this automated system this couldn’t be much more complicated than my advanced data science course work, so I inquired about the job and came on-board.

This was back in my college days when I was learning about concurrent programming in Java (threads, semaphores, and all that junk). My First ClientĪround this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Soon, I was spending hours reading about algorithmic trading systems (rule sets that determine whether you should buy or sell), custom indicators, market moods, and more. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. But you might not be aware that it’s the most liquid market in the world.Ī few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations (with fake money) on the Meta Trader 4 trading platform.Īfter a week of ‘trading’, I’d almost doubled my money. As you may know, the Foreign Exchange (Forex, or FX) market is used for trading between currency pairs.

0 kommentar(er)

0 kommentar(er)